There have been a couple interesting developments since my last commentary from even a couple days ago. Most important of which is that the Federal Reserve openly acknowledged the slowing growth I warned about previously here, here, here, here, here, here, and here.

In response, the Federal Reserve announced they do not expect to raise interest rates again in 2019 and will end their balance sheet tapering in September. Therefore, the balance sheet will stand at about $3.5 trillion once the Fed is done. That’s about 4x larger than it was on the eve of the Great Recession of 2008!

Prediction: I believe the Federal Reserve will actually end up lowering interest rates before they raise them again as slow growth continues to grip the globe.

But here are a couple big picture market stats I found interesting:

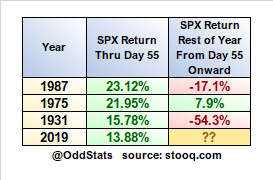

1. As of Thursday’s close, this year experienced the fourth best start to any year for the S&P 500 ever (through day 55)! Here are the top four instances showing the return through day 55 along with the return for the rest of the year from that point.

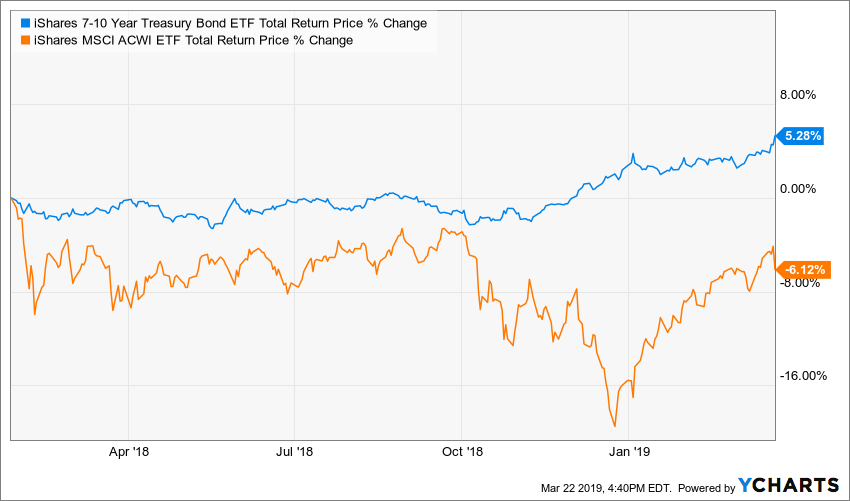

2. U.S. Treasuries (Symbol: IEF) have outperformed the global stock market since global stocks (Symbol: ACWI) peaked on January 26, 2018. Did you know IEF made over 18% in 2008 when stocks lost almost 40%?!

3. The global stock market has officially been in a bear market since its peak on January 26, 2018, or for more than a year! Here’s what really interesting -> This bear market wasn’t confirmed until late-December of 2018, which means the global stock market was already in a bear market for about 11 months before it was even confirmed! I wrote about this lag effect here in my commentary titled “Signals Through The Noise.” Specifically, I said…

“A tricky thing about bear markets, however, is that we can be in one for a long time before we even realize it. That’s because bear markets can only be confirmed in hindsight only AFTER losses have become sufficiently severe.”

“If the peak for the current cycle was indeed set on January 26, 2018 than we may not get confirmation of a bear market until January of 2019 if history were to repeat.”

Well, I was one month off. To be fair, I was referring to the S&P 500 but the lag effect is the same for the global stock market (MSCI All Cap World Index) as well.

So it’s not that the market will enter a bear market eventually, it’s already here right now in this very moment. Now the important questions are, (a) How far will the market fall in this bear market, (b) How long will the bear market last, and (c) What assets and strategies have the potential to provide positive returns in that environment?

My clients can sleep well knowing I am not asleep behind the wheel and am proactively navigating through these conditions. They know my goal is to help them become and remain financially independent across various market environments. This doesn’t mean they are insulated from losses, but the goal is to help them achieve their financial objectives even in the face of adverse markets.

Over the last year, I’ve talked to a lot of advisors and seen a lot of new client portfolios. Far too many are woefully unprepared and are jeopardizing everything they’ve worked and saved for because they have far too much risk given current market fundamentals along with their unique circumstances.

I am happy to offer a complimentary portfolio review to help you identify your portfolio strategy/allocation and expenses.

Past performance is no guarantee of future results. This is intended as general education only and NOT investment advice.

All investments have the potential for losses. There is no guarantee financial objectives will be met. Losses are a natural, unavoidable characteristic of investing.