I’d like to review my comments on bonds over the last couple years. The financial media, and retail investors along with their advisors, tend to focus a lot on stocks as stock markets are perceived as “sexier” while the bond markets often receive the cold shoulder.

Honestly, this is largely the reason that bond and credit markets are “smarter” than the stock markets. After all, how many retail investors do you know that open a brokerage account so they can trade bonds? Almost none (I’ve never known a single retail investor to do this actually).

In other words, there’s a lot more retail money “investing” in the stock markets than in the bond markets.

With that being said, let me summarize some comments I’ve made regarding the bond markets over the last couple years and include a chart to see how those comments have stacked up.

Example #1

In my November 1st, 2017 commentary titled “This Has Never Happened Before. The MOST Extreme Stock Market Valuations in History” I offered some strategies for complimenting and/or hedging stock exposure given that stock market valuations were hitting their highest levels in history:

- Hedge the bond sleeve of your portfolio against credit risk by maintaining high-quality bonds. High-quality bonds have a better probability of benefiting from a “flight to quality” during economic or market stress. Underweight high yield / junk bonds that are typically more correlated with stocks. In times of stress, you want your bond sleeve to be a buoy for the rest of your portfolio.

- Hedge your bond sleeve against the risk of rising rates by shortening the duration of your bond portfolio. Conversely, for very aggressive investors with 70%+ stock exposure consider longer-dated Treasuries within your bond sleeve as those may act as a better hedge against stock market declines than shorter-dated bonds.

So, there I discussed improving the quality of your bond portfolio (Treasuries are traditionally considered the “safest” bonds) as well as hedging heavy-stock portfolios with longer-dated Treasuries.

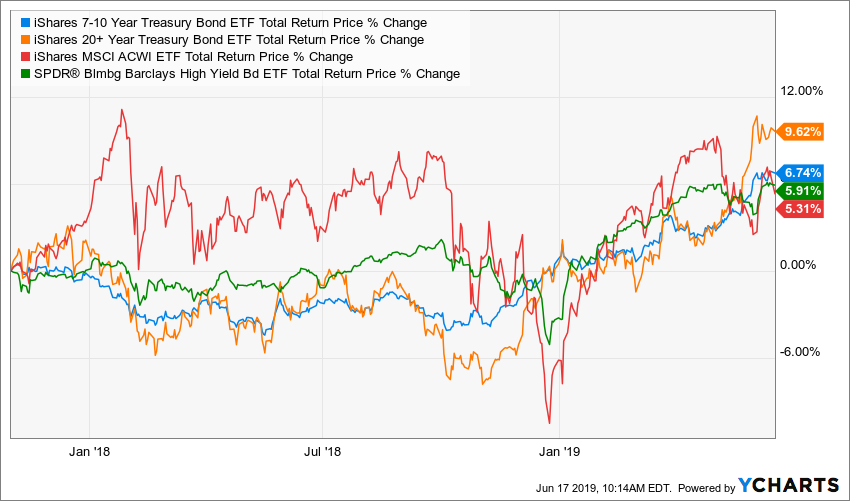

Here’s a chart showing the total returns of the global stock market (red line) with intermediate-term Treasuries (blue line) and long-term Treasuries (orange line) as well as low-quality “junk” bonds (green line) since 11/1/2017.

Notice the two worst performers were stocks and high yield bonds. Also notice the amount of volatility (i.e. “risk”) associated with stocks and high yield bonds. So, not only did they under-perform but they did so with a lot more risk! That’s not a good tradeoff, and the bear market hasn’t even gotten in full swing yet.

Example #2

On February 3, 2018 I wrote a commentary titled, “Friday’s 666-point decline puts the Dow back at levels not seen since…” In that commentary I said:

“…I eventually believe there could be a “flight to quality” back to bonds when stocks really start getting beat up…”

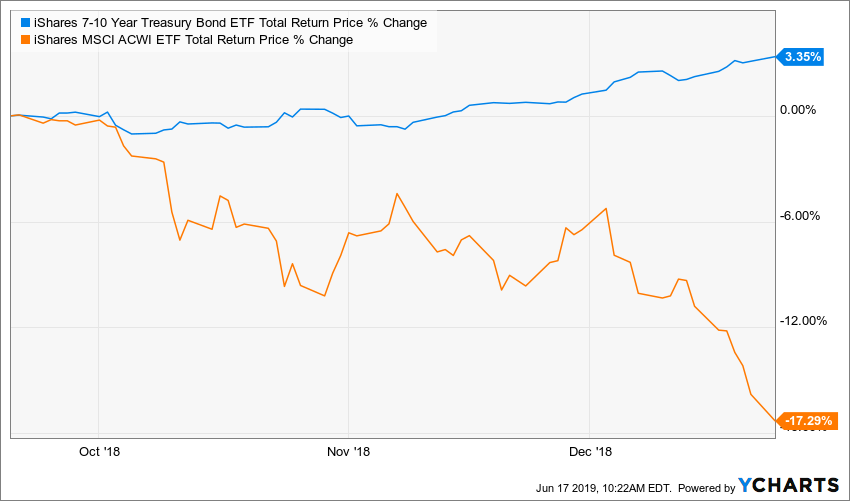

Well, let’s see how Treasuries performed relative to stocks in a period where stocks got beat up, which was just later that year in the fourth quarter of 2018. This chart is from 9/20/2018 – 12/24/2018, which covers the period where stocks got hammered last year.

Sure enough, intermediate-term Treasuries made 3.35% while global stocks lost over 17% in just three months! So, Treasuries performed as I expected they would when stocks were getting beat up.

Example #3

On March 19, 2018 I said, in the commentary titled “How I’m Managing Bond Investments At This Stage in the Cycle,”

“A couple proactive approaches I’ve offered for consideration to preserve financial independence is either (1) under-weight U.S. stocks in favor of other asset classes, including bonds…”

I then went on to say,

“Because I believe we are very late in the economic and market cycles, I am avoiding high-yield / junk bond funds. The reason for this is that high-yield / junk bonds tend to be highly correlated with stocks especially when stocks are stressed. This means you don’t get the diversification benefits you need from your bond investments when you most need it because both high-yield bonds and stocks decline together. Investors need their bond portfolios to hold up well when stocks are declining. That is one of the primary reasons (in addition to income generation) for holding bonds in the first place! So it doesn’t make sense to take “equity-like” risk within the bond sleeve at this point in the cycle.

Over the last couple months, I’ve also gone so far as to shift away from investment-grade corporate bonds in favor of U.S. Treasury bonds. The result is a very high-quality bond sleeve with a heavy tilt to Treasuries. Treasuries tend to hold up much better than both high-yield and investment-grade corporate bonds when stocks are falling.”

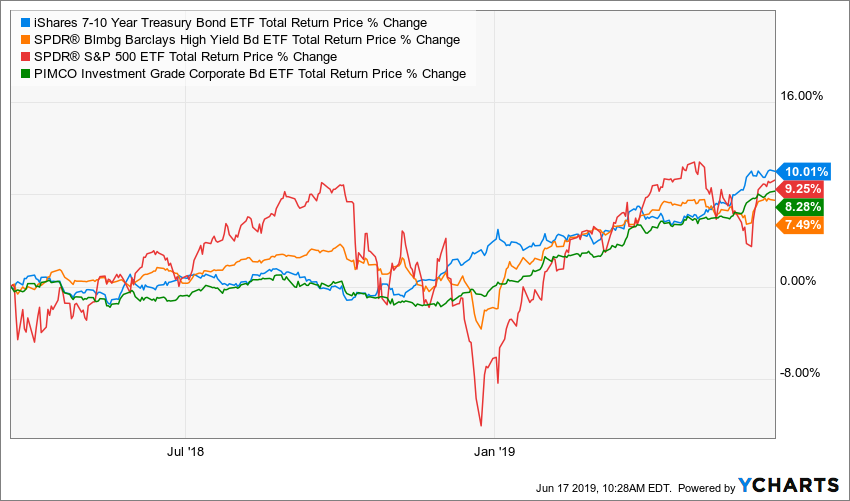

So, how have Treasuries (blue line) performed relative to U.S. stocks (red), high-yield bonds (orange) and corporate bonds (green) since then?

For this particular time period, there isn’t a tremendous difference although Treasuries did out-perform all the other asset classes mentioned. And, again, look at the volatility of stocks compared to bonds during the period.

Stocks and junk bonds provided less return than Treasuries with far more risk. Not a good risk-return tradeoff.

Also, consider how the relative performance would have looked through the end of 2018 when stocks were down almost 20% from their highs? That could be just a preview of what this chart may look like in the depths of a full-fledged bear market.

Example #4

On May 3, 2018 I said, “I believe if stocks experience significant, sustained stress that Treasuries will hold up far better than stocks and may even appreciate.” I’ve already shown that to be the case in Q4 of 2018 above.

Example #5

In the commentary titled, “Bond and Stock Behavior Throughout History,” I pointed out some interesting stats about the relative performance of stocks and bonds over time.

One of the things I pointed out was that:

“the S&P 500 and 10-year Treasury Bonds have BOTH lost money in the same calendar year only FOUR TIMES! …not including dividends…with dividends it’s only been three times.”

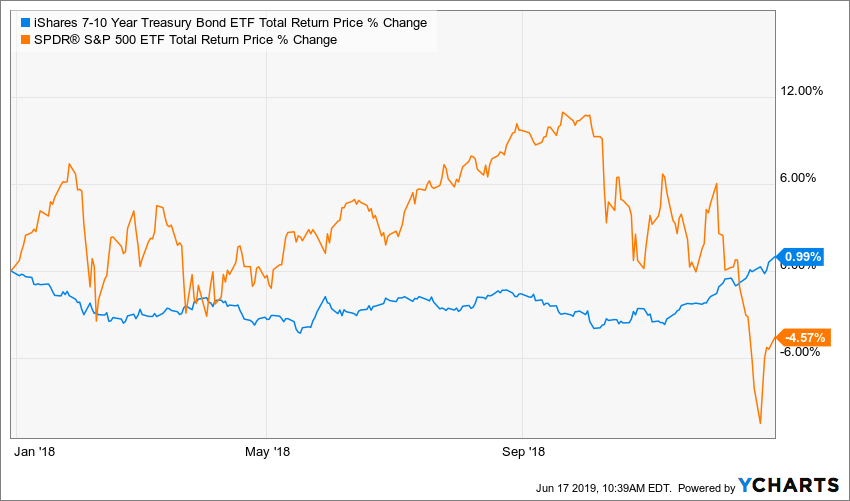

Well, how did Treasuries do in 2018 when the S&P 500 lost about 4.5% (including dividends)? Sure enough, Treasuries eked out a positive return for the year:

Always remember that past performance is no guarantee of future results.

There are many reliable relationships in investing but none of them hold up at all times in all places. These relationships can and do break down…even the most reliable ones.

This commentary is not investment advice but merely education. This commentary is intended to show that as hated as bonds have been for the last few years (especially safe Treasuries), they have been a spectacular diversifier to traditional stock investments as I predicted they would be. I also seem to have been right on the money when it came to Treasuries relative to stocks, lower-quality bonds and even investment-grade corporate bonds.

I believe Treasuries will do well again in the next significant stock decline, but we must acknowledge the potential performance for Treasuries is less than it was last year because interest rates are now lower. Whereas, last year, 10-year Treasuries were paying upwards of 3.3% interest at times, 10-year rates have fallen to 2.1% as Treasury prices appreciated. This implies there is less room for error/less cushion going forward while projected returns of Treasuries for the next ten years are also lower than they would have been last year. The question is, are the projected 10-year returns for Treasuries still higher than the projected 10-year returns for stocks?

Kindest Regards,

Ken

You can find all the commentaries referenced, along with many others, on my blog at: https://melottefa.com/blog/