Yesterday afternoon, FedEx reported disappointing global revenue and earnings. This is important because package delivery tends to be closely correlated with the strength (or weakness) of the economy.

But not only did they report weaker-than-expected results, FedEx also issued an overt warning about the global economy. Specifically, FedEx’s chief financial officer stated, “Slowing international macroeconomic conditions and weaker global trade growth trends continue, as seen in the year-over-year decline in our FedEx Express international revenue.” [emphasis mine]

For anyone reading my commentaries, you’ll know I’ve been warning about slowing growth and the increasing probability of a recession. Over the last month I’ve written about some recessionary signals here and here. In the first of those commentaries, I mentioned one signal still providing the “all clear” was the U.S. Purchasing Managers Index (i.e. PMI – measures health of manufacturing), which was still reflecting expansion as of February. However, we’re seeing PMIs around the world more broadly deteriorate and even contract in China. Global PMI has fallen to an almost 3-year low. These are signs of slowing growth.

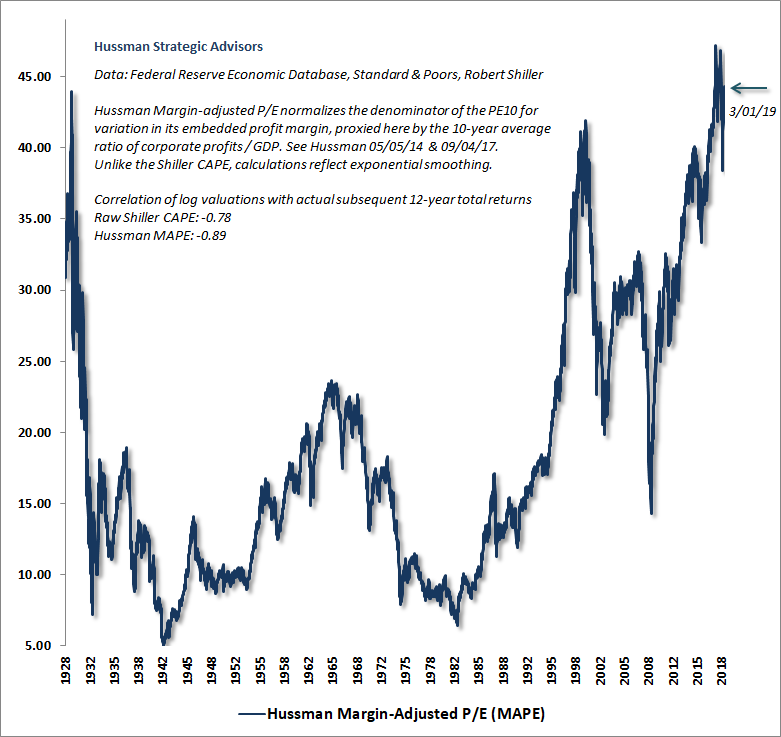

Keep in mind, this is all occurring even as the U.S. stock market is back to its most extreme valuations in history thanks to this powerful rally of the last three months.

Some takeaways from extreme valuations based on common sense AND historical occurrences:

- Robust returns have been pulled forward from the future and now lie in our past.

- Returns for U.S. stocks over the next decade are likely to be low.

- These low returns are more likely to be caused by a sharp decline (50% or more) rather than low annual returns for each of the next ten years. The silver lining is that a sharp decline creates opportunity for disciplined and patient investors!

- U.S. Treasuries may outperform U.S. stocks over the next decade.

- Performance of other “risk” assets may be dragged down as well.

- At some point, the Federal Reserve will likely intervene to an even greater degree than ever before creating its own unique opportunities for investors and advisors who understand history.

Some slowing growth / recessionary signals in addition to those written about in the past month:

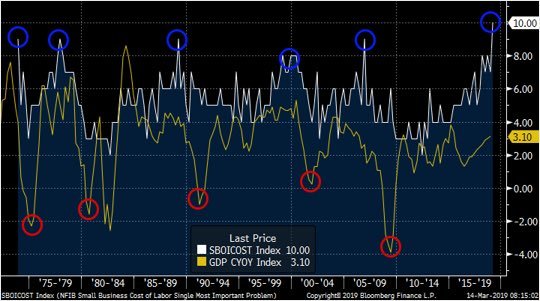

NFIB’s “cost of labor” index hit a record high last month, This index has historically been a strong predictor of recessions.

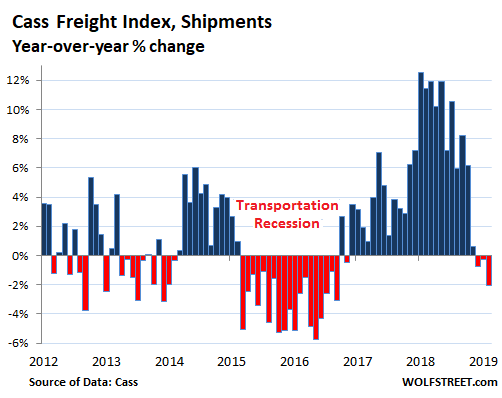

The Cass Freight Index, which measures freight shipment volume across all modes of transportation, has now posted three consecutive months of year-over-year declines.

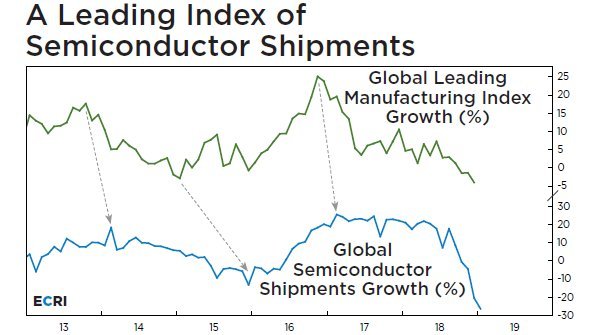

ECRI’s leading index of semiconductor shipment/demand is contracting. “The canary in the semiconductor-chip fab has keeled over.” – Lakshman Achuthan

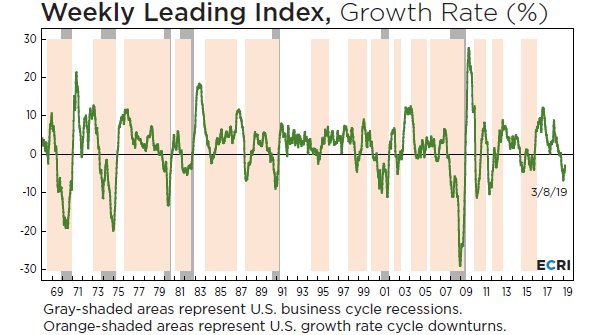

ECRI’s weekly leading index is also contracting

There are more, but, for sake of brevity, I’ll leave you with the Atlanta Fed’s Q1 GDP forecast, which they have estimated at an anemic 0.4% annualized pace for this first quarter.

Past performance is no guarantee of future results.

Data herein from third parties is believed to be reliable but accuracy is not guaranteed. This is not intended as investment advice but general education.