Within my email inbox I’ve created a folder where I store anything interesting I come across. Today, I’m sharing a couple of those interesting market stats with you.

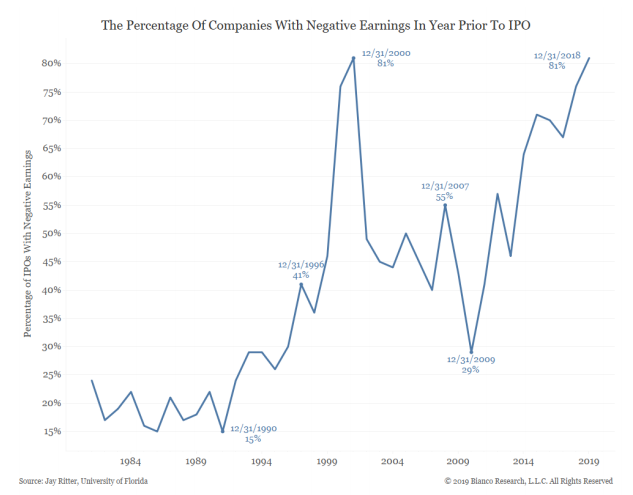

In May, JP Scott shared a chart showing the percentage of companies with negative earnings in the year prior to IPO. As of 12/31/2018, this percentage stood at 81% tying the previous record from the height of the dot-com bubble.

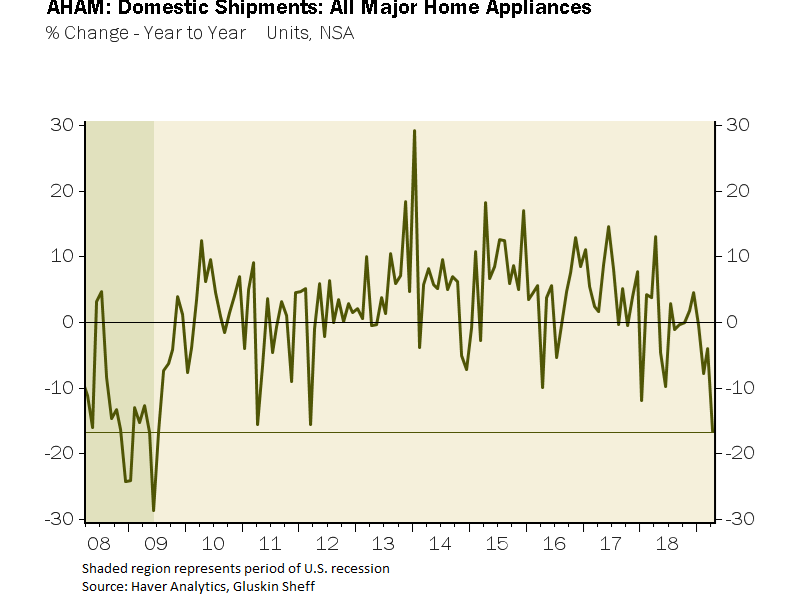

Next, is a chart from David Rosenberg showing appliance shipments collapsing to levels last seen in the Great Financial Crisis / Housing Bubble Burst.

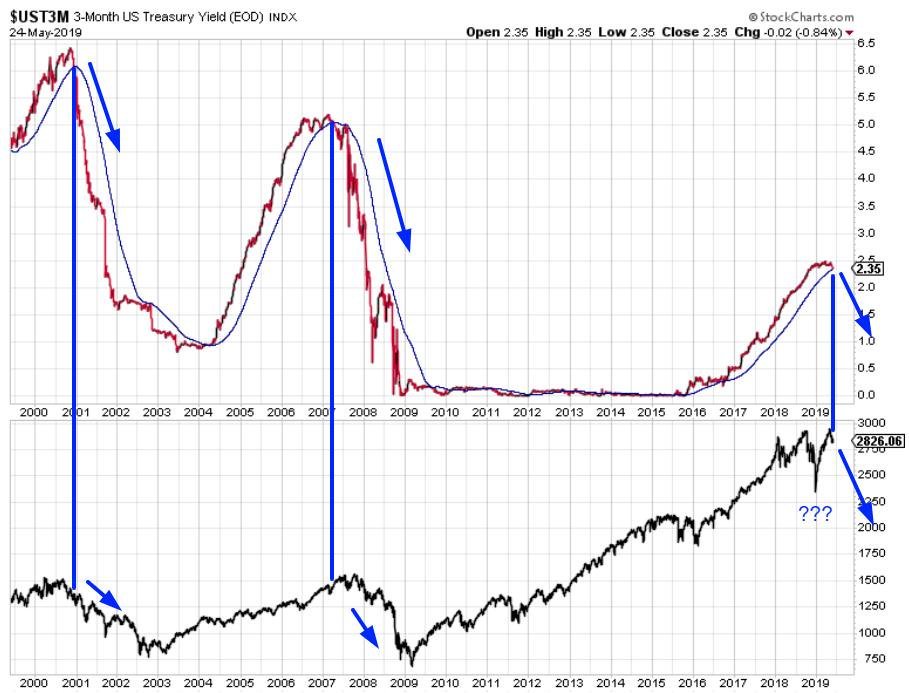

Here, Troy Bombardia, illustrates that the 3-month Treasury yield falling below its 200-day moving average. Over the past 20 years that has happened only two other times, 2000 and 2007. Do those years stand out? They should. If not, you should know that the dot-com bubble peaked in 2000 and the housing bubble peaked in 2007.

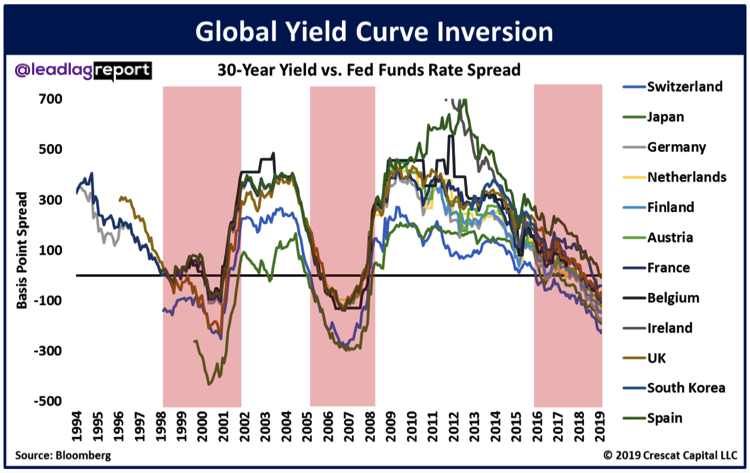

In this chart, Michael Gayed shares a chart illustrating yields on 30-year government bonds from around the world compared to the Fed Funds Rate Spread. Notice anything?

Here, Tavi Costa shows us that the U.S. 2-year Treasury Yield is on pace for dropping for its eighth straight week! He also points out this has happened only eight other times in history…all of them during bear markets and/or recessions.

Just today, SentimentTrader posted an analysis of the S&P 500 relative to Small Cap, Transport and Bank stocks. Over the last 40 years, only two times has the S&P 500 hit a new high while these three other classes collapsed to relative lows. Both of those instances saw a 15% drop in the S&P 500 within two months.

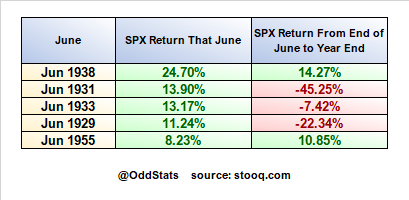

And, finally, Twitter user @OddStats mentioned that as of 6/22/2019 the S&P 500 was up over 7.7% for June, which would be the 6th best June ever. Here are the top 5 Junes along with returns for the rest of the year. Not particularly great company to keep:

Please note, none of this is intended as investment advice or grounds for making short-term trades. This is purely educational.

I think it’s important investors understand how current setups are similar, or may differ, from setups of the past. It’s also important that investors don’t chase performance and that they, instead, remain disciplined and committed to their long-term investment strategy.