I was asked a great question by a client this morning. “With all this news of rate cuts from the Fed, how does this impact my portfolio?”

The market has broadly rallied on expectations that the Federal Reserve would begin lowering interest rates again…likely even at its next meeting (July 30-31). This is an action the Fed hasn’t taken since the Great Financial Crisis of 2007 – 2009.

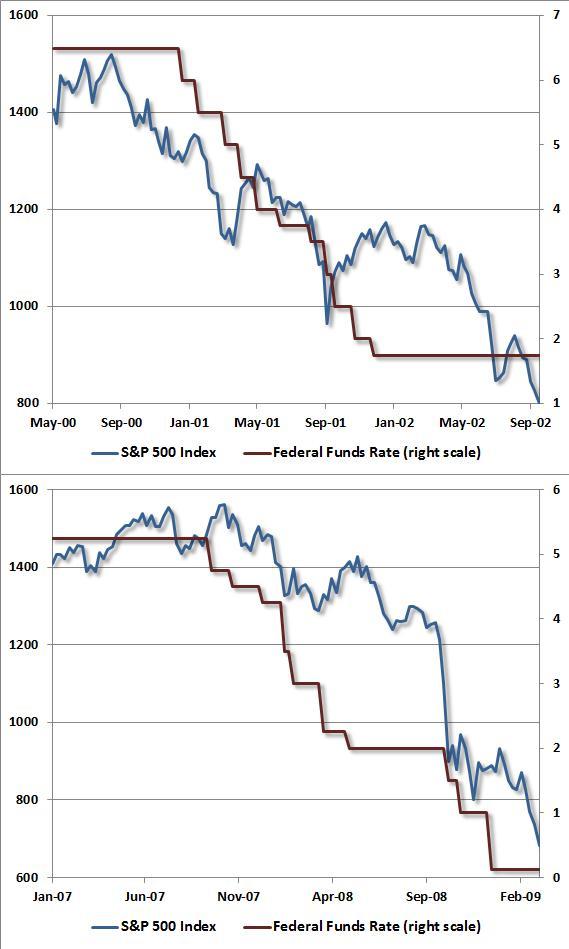

But how has the market actually performed, historically, once the Fed has begun easing after a period of tightening? It’s not necessarily bullish at all:

- “On average, at the first rate cut, the S&P 500 has been down over 12%. By the second rate cut, the max drawdown from the high has exceeded 20%.” Median drawdown has been 18% – Dr. John Hussman

- “The problem,…is that with the exceptions of 1967 and 1996, every initial Fed easing (ultimately amounting to a cumulative cut of 0.5% or more, following a period of tightening in excess of 0.5%), has been associated with a U.S. economic recession.”

- In January of 2001, the Fed rate cut triggered strong gains, “but by late March stocks had declined 20%.” – Danielle DiMartino Booth

The advice? Don’t run toward the fire. No sense risking a severe burn, or worse. The risk / reward ratio is not favorable at this time when market valuations are at historic extremes. In plain English, don’t take on more risk than you can afford. A conservative bias in your portfolio (relative to each household’s unique circumstances) is likely prudent.

Care to see how the market performed during the last two rate cut cycles? See below. The reason performance was so poor? The Fed cuts rates when the economy is weak / falling short of growth objectives. It’s not positive that the Fed feels the need to cut rates.

Remember that my view has long been that the Federal Reserve would end up easing monetary policy (e.g. cutting interest rates) again long before it ever got to back to “normal.” It appears that view will be confirmed at their meeting next week as the market is pricing in a 100% chance of at least a 0.25% rate cut.

Past performance is no guarantee of future results. All investments maintain risk of loss in addition to gain.

Data from third-parties is believed to be reliable but accuracy is not guaranteed. Much of the data used to interpret the markets and forecast returns are often at odds with each other and can result in different conclusions. Many different factors impact prices including factors not mentioned here.

This is NOT investment advice but merely a general commentary. Individualized investment advice cannot be provided until a thorough review of your unique circumstances and financial goals is completed.