There have been very strong secular trends in play for the last decade. So, I wanted to take a moment to highlight those for you.

The last ten years have been largely characterized by a domination of U.S. large cap growth stocks over every other major asset class.

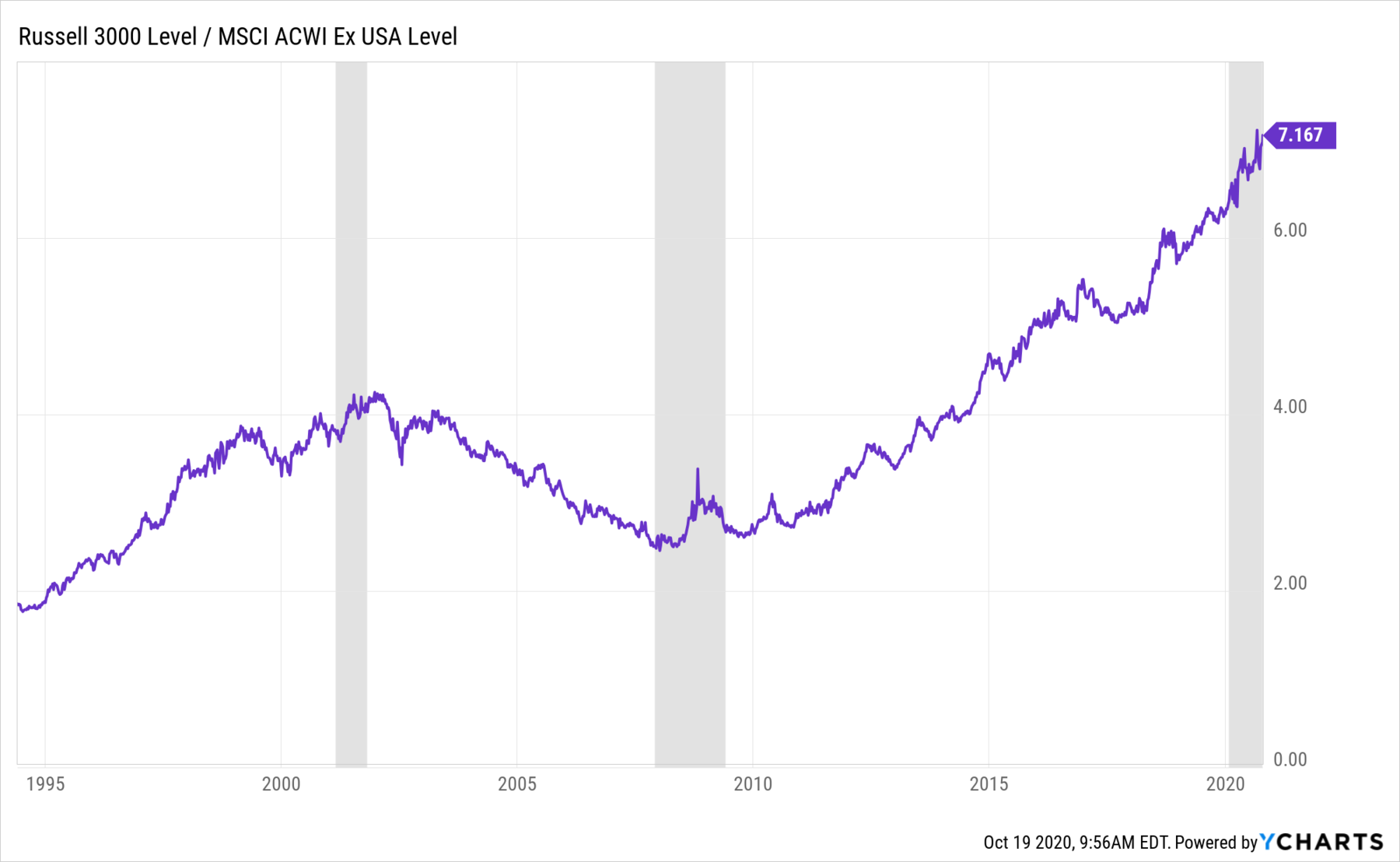

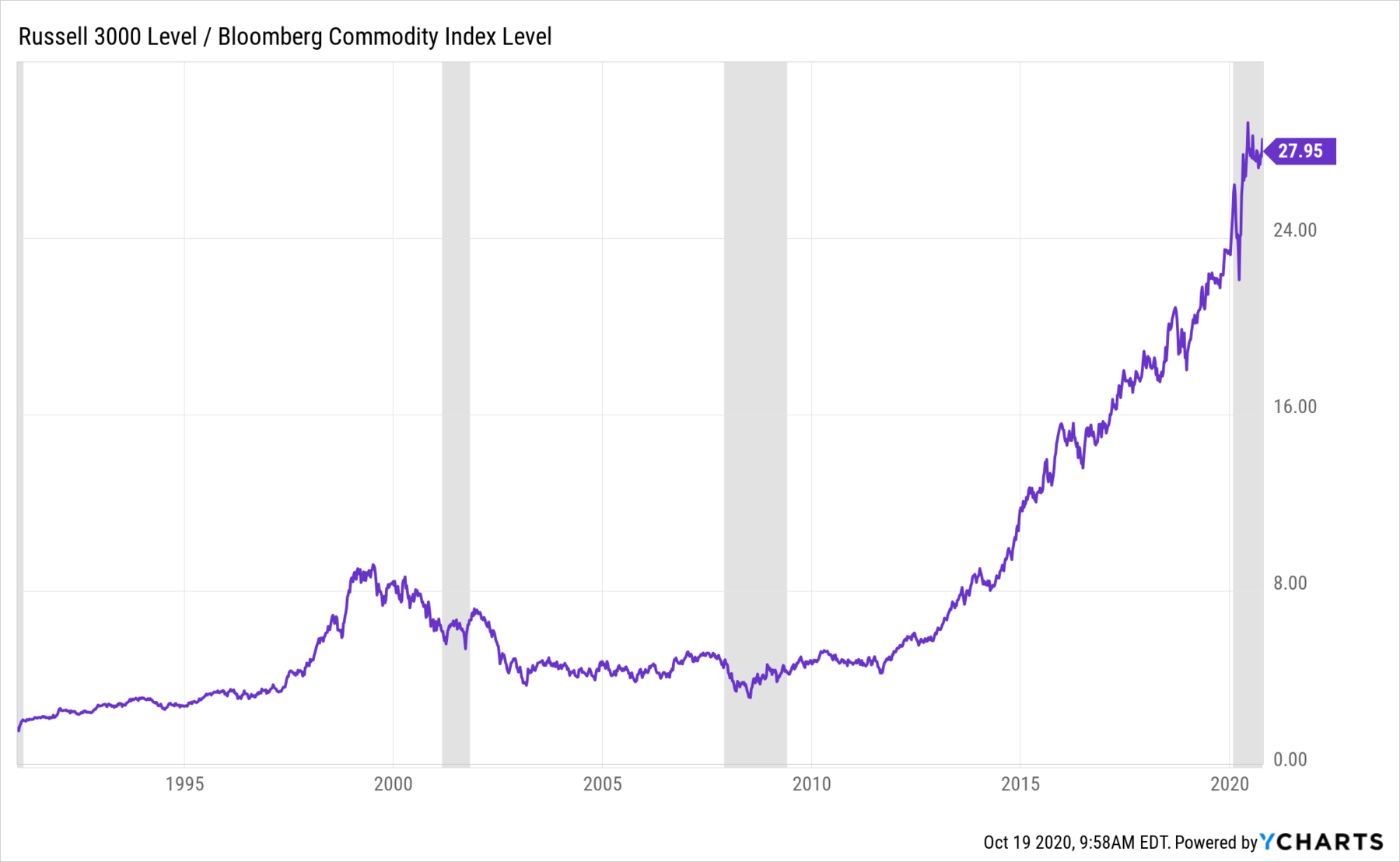

- The U.S. stock market has dominated foreign markets and commodities

- Within the U.S. market, large cap stocks have dominated small cap stocks

- And within U.S. large cap, growth stocks have dominated value stocks.

U.S. Stocks vs. Foreign Stocks

Large Cap Stocks vs. Small Cap Stocks

Growth vs. Value

U.S. Stocks vs. Commodities

The question is, “Will the next ten years look like the last ten years?” Probably not.

Kindest Regards,

Ken

Disclosures:

Past performance is no guarantee of future results. All investments maintain risk of loss in addition to gain.

Data from third-parties is believed to be reliable but accuracy is not guaranteed. Much of the data used to interpret the markets and forecast returns are often at odds with each other and can result in different conclusions. Many different factors impact prices including factors not mentioned here.

This is NOT investment advice but merely a general commentary. Individualized investment advice cannot be provided until a thorough review of your unique circumstances and financial goals is completed.

Views provided here are current only as of the moment of posting and are subject to change at any time without notification.