What a year.

The widely followed S&P 500 index ended 2020 over 16% higher (18.4% total return w/ dividends) than it began the year even as it experienced one of the sharpest 34% declines in history (mid-February to mid-March).

The U.S. stock market managed a great year even in the midst of a global pandemic that saw businesses shut down, tens of millions of people lose their jobs, spike in corporate defaults, a steep recession (we’re still in BTW) and S&P 500 earnings that declined 13.6% from the prior year.

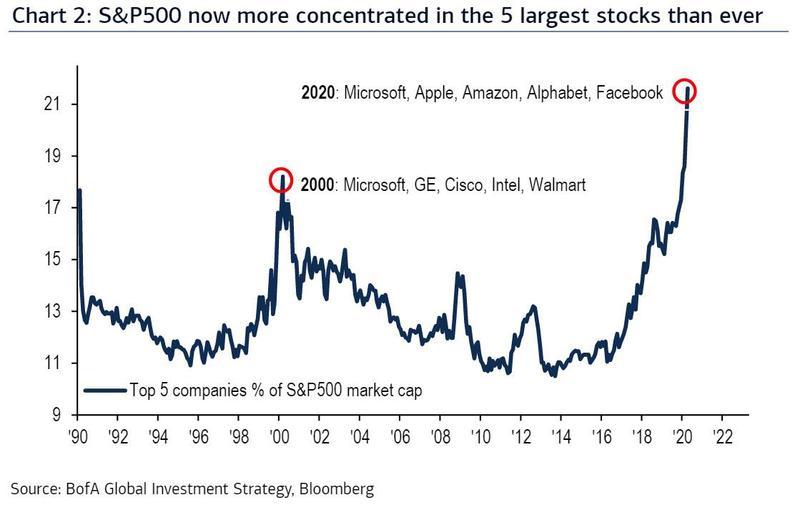

This means the entire increase in the S&P 500 was from expansion of the Price/Earnings multiple to over 30x, which is a level ONLY seen throughout history in the Dot-Com Bubble and Great Financial Crisis. The long-term average is about 16x. Continue reading “BRIEF: Year End Market Returns Summary”