You may have noticed larger price swings in the market over the last couple months. Another term for this is “volatility.”

Increasing volatility is normal as markets transition from up-trends (bull markets) to down-trends (bear markets). And, actually, large price swings IN BOTH DIRECTIONS are characteristic of bear markets.

Now, it’s reasonable to expect to see most of the worst daily returns in history during bear markets. However, what I found far more interesting when doing my analysis is that most of the best daily returns also occur during bear markets. In fact, eight out of the ten best days in the market (1950 – 2018) occurred during bear markets!

For example, the single best day in the S&P 500 since 1950 was 11.6% on October 13th, 2008 smack in the middle of the worst financial crisis of our lifetimes! The second best day occurred just two weeks later on 10/28/2008. In fact, the 1st, 2nd, 5th, 6th, 8th and 10th best days since 1950 all occurred in 2008. But, in 2008, the S&P 500 lost almost 40%! The S&P 500 lost about 55% from the peak to the trough of that cycle (10/2007 – 03/2009).

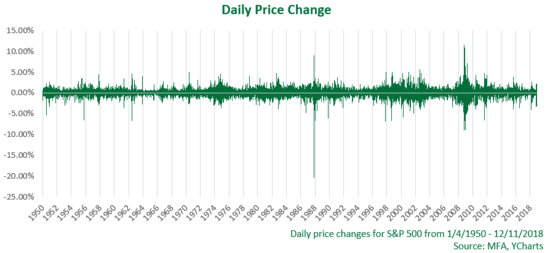

Here is a chart I’ve shared recently that shows all the daily returns from 1950 through yesterday. You’ll notice that there are periods of low volatility (small daily price swings) followed by period of high volatility (large daily price swings). The magnitude of daily price swings is reliably cyclical as you can see by the wave pattern. Furthermore, notice periods of high volatility occur during bear markets.

Kindest Regards,

Ken

Past performance is not a guarantee of future results. Not intended as investment advice but general education.

Data from third-parties is believe to be reliable but accuracy cannot be guaranteed.